Four For Friday | Feb 16, 2024

LF109 | McKinsey on healthy cities, the increasingly uninsurable world, a new community resilience bond, and friends who care for each other

Welcome to Looking Forward’s Four For Friday. Four things that have piqued my interest this week. Enjoy!

Cities can deliver 25bn healthy years

McKinsey Health Institute suggests that focusing on short term interventions in cities can deliver 20-25bn new healthy years.

Cities are where there are some of the largest health discrepancies existing within just a few kilometers, are economic centers of power and where a local leader can drive multi-stakeholder collaboration.

Interestingly enough, only 37% of large cities have a health officer, compared to 100% of countries.

The four levels of interventions they recommend:

Healthy longevity interventions (including those that address cancers, cardiovascular diseases, and diabetes)

Brain health interventions (including initiatives that address mental, substance use, and neurological conditions)

Climate-related health interventions

Interventions that improve health-worker capacity.

An increasingly uninsurable world

The Financial Times on the increasingly uninsurable world - one in which carbon pricing is hitting individuals. Thirty-seven $1bn dollar plus extreme weather events in 2023 was a historic high. And recently, four consecutive years have seen losses from natural catastrophes topping $100bn.

Homeowners around the world are facing stress. For example, in Australia, the number of people facing “home insurance affordability stress” has risen 24% in the last year.

This raises questions that are at the intersection of business and public policy, especially as many places have government subsidies for homeowner insurance. Rather than expect the private sector to always have affordable insurance available, policy makers will need to think about where they allow people to live and what building codes they enforce.

New community insurance resilience bond launched

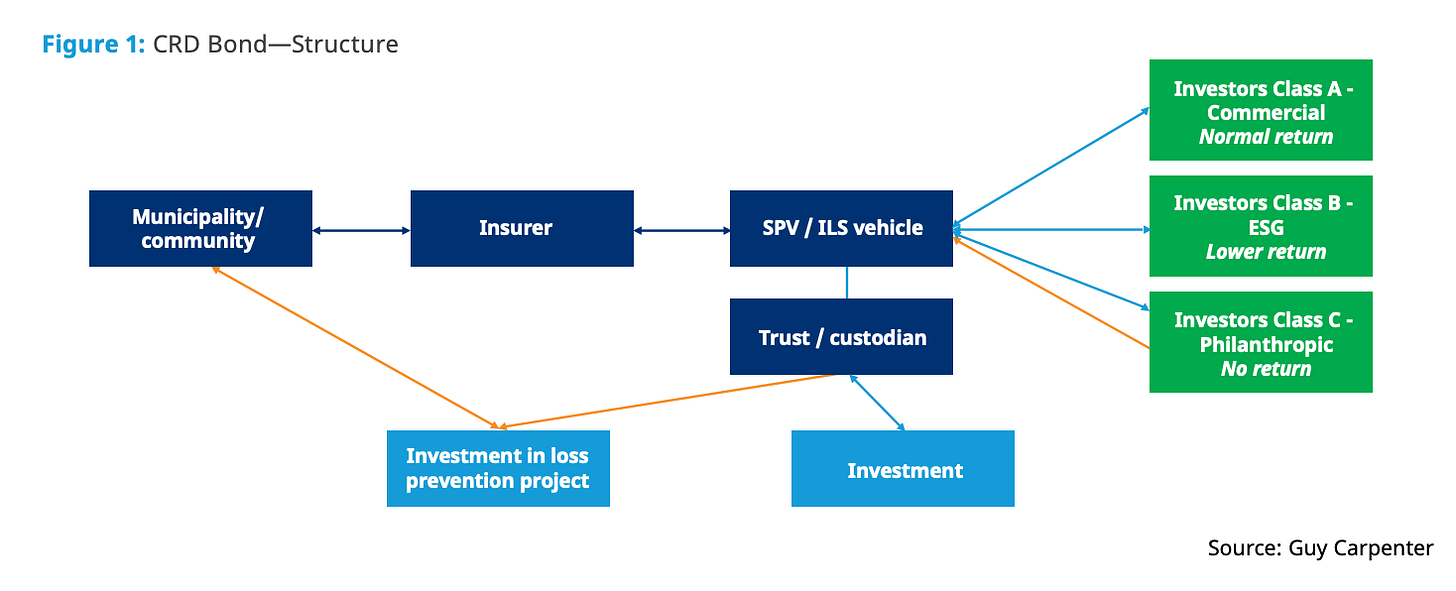

Insurance expert Guy Carpenter has released a new product proposal for a bond that would allow a municipality to both invest in resilience measures to address climate change and receive insurance. Key elements of the model (below) are:

City collective. The municipality as a whole develops into a long-term relationship with an insurance partner. This address the ‘tragedy of the commons’ in which insurance companies aren’t motivated to invest in long term improvements as their clients may switch to a free-riding competitor.

Blended finance. The model brings together philanthrophic and impact investors as well as commercial bond investors. In that way, there is more capital to invest in the resilience project that doesn’t require commercial returns.

Combining project funding and insurance. The bond would deliver both project investment for the resilient interventions as well as financial insurance in the event of catastrophes. Part of the challenge will be ensuring there’s sufficient capital to pay back the bond at the end of the loan term.

Will be watching this product will interest to see which town is the first to implement.

Friends who care for each other

The Atlantic on people who decide to care for each other, often because they don’t have other close family members, creating a new care dynamic:

It opens up a different, less hierarchical model of caregiving based on not a relationship of dependence but one of equality..

That’s all for this week. As always, feedback welcome. Feel free to share insights or links of interest.

- Stephen