Four For Friday | February 21, 2025

LF161 | Safeguarding elections from AI, end-of-life policy, longevity insurance, problematic bachelor philosophers + bonus: AI strategy reports.

Welcome to this week’s Four For Friday. Four things that have piqued my interest this week, together with a bonus: AI Tip of The Week.

6 steps to preserve electoral integrity in the age of AI

Few things are more important to get right in the age of AI then electoral integrity. We’re seeing systems around the world that were ‘designed’ in a pre-Internet age (let alone a pre-AI one) struggle. Going forwards it’s ever harder to know truth from lies, with potentially seismic implications.

The ever productive and interesting Geoff Mulgan has put together a framework for safeguarding elections in the age of AI:

The EII framework: 6 steps to safeguard elections

SET the right foundations – Define the institution’s mandate, structure, and core principles to ensure long-term effectiveness.

FACILITATE collaboration – Build alliances across government agencies, technology platforms, civil society, and academia to coordinate a strong response.

SCAN the digital space – Use AI-driven tools and human expertise to proactively monitor and detect misinformation before it spreads.

ASSESS content effectively – Implement a tiered evaluation system to determine the severity, reach, and credibility of flagged content.

ACT with power and accountability – Enable swift interventions through democratic oversight, ensuring that responses are proportional and protect free speech.

LEARN via feedback loops – Continuously refine strategies by analysing institutional performance, engaging global counterparts, and anticipating future threats.

The So What? A functioning democracy requires trusted elections, and the window to preserve what’s left of these is rapidly closing.

The desperate need to fix end-of-life care

The Health Reform Group is “an unincorporated, unaffiliated, unaligned group of leading clinicians, academics and community members interested in advancing issues of importance to the health of Australians”. Despite being an informal, ‘semi-regular’ supper club (of which I’ve been invited along a few times) they’ve had quite an impact, influencing both mindsets and regulations for good.

The notes from last week’s end-of-life focused session are particularly rich, given the significant challenges faced by this issue in Australia and most countries; patients are families’ quality of life is often sub-par (to put it mildly), whilst health costs continue climb and staff morale suffers. A few key points:

Prof Ken Hillman highlighted systemic inefficiencies in caring for frail elderly patients, often resulting in unwanted or low-value interventions.

The discussion proposed community-based care navigators to advocate for patient needs.

Dr Linda Swan addressed Voluntary Assisted Dying (VAD) policy evolution across Australia. Victoria's pioneering legislation was most restrictive, while the ACT's recent laws are most liberal.

Key challenges include medicare payments access for VAD practitioners and opposition from conservative medical groups and faith-based organisations (who tend to dominate the palliative care providers in the country).

The salon recommended harmonising VAD laws nationally, improving MBS access, and streamlining VAD processes.

For elderly care, earlier identification of terminal illness and robust end-of-life conversations were advocated.

The So What? Few things are a bigger inditement of society than a broken end-of-life system, which can brutalize patients, families and budgets. A worthy mission to change.

Insurance and the longevity economy

A detailed and insightful report by the Geneva Association on how the insurance industry is likely to be impacted by the coming 100-year lifespans.

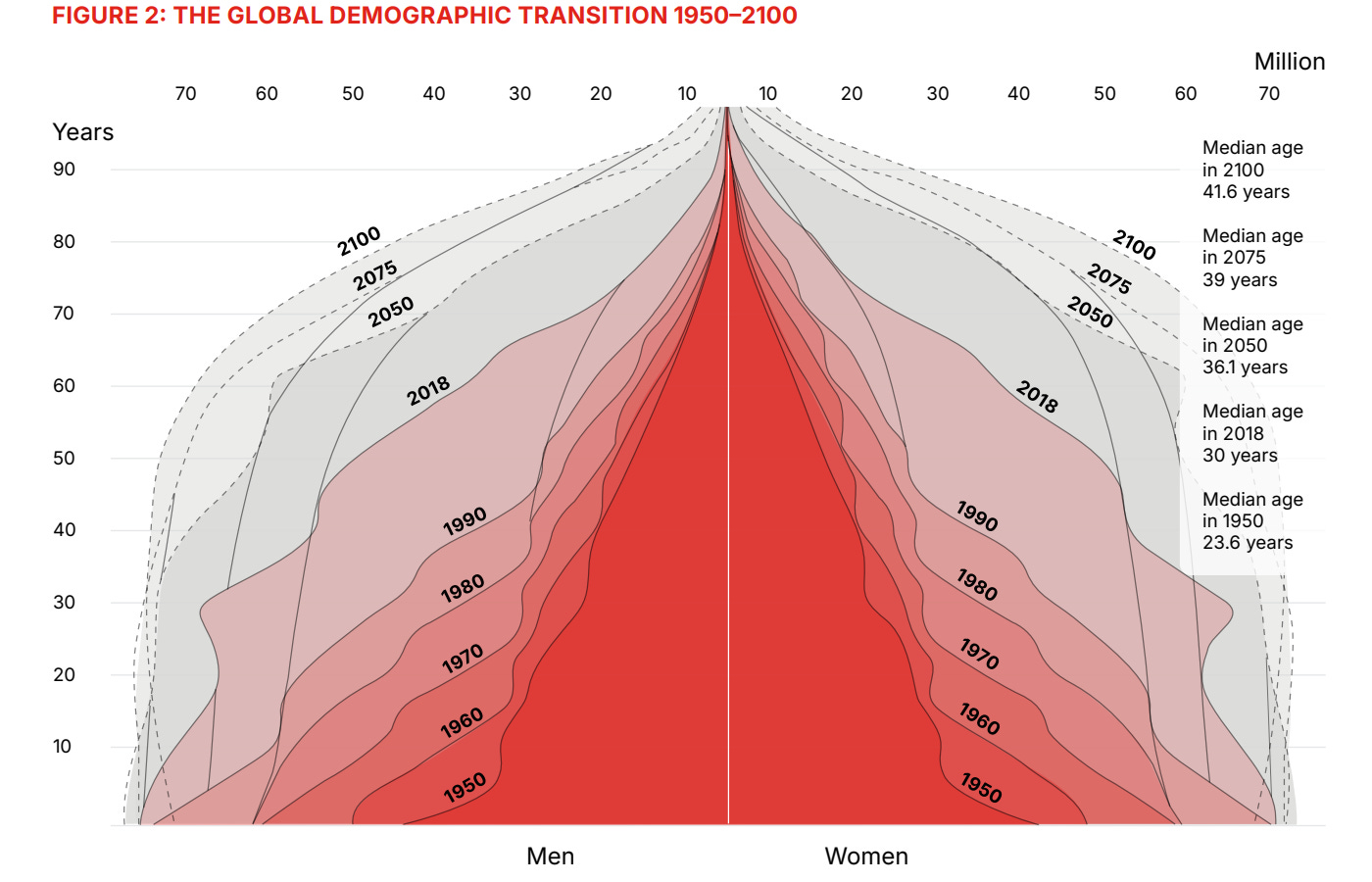

First the context. This eye-popping chart shows the demographic transition happening around the world between 1950 and 2100, which has far-reaching ramifications.

The report identifies three metrics that are increasingly often misaligned: lifespan (how many years you life), healthspan (how many of them are in good health) and wealth span (whether your money survives as long as you do).

The gaps between lifespans (81+ years in OECD countries) and "health spans" (healthy years of life, roughly ten years less, depending on the country), creates a USD $1 trillion annual pension protection gap - i.e. a population’s unfunded retirement costs.

The report states that

72% worry about healthcare access in old age

Only 23% have long-term care insurance despite 44% interest

35% of Americans 65+ still working, up from 27% in 2003

Older adults’ relative poverty rate is 20% in Japan and a massive 40% in South Korea

As a result, insurance companies need to develop data-driven, hybrid products combining mortality, longevity and health risks as traditional retirement models become obsolete. Examples include closer links between life insurance and health, integrating mortality and longevity risks into insurance and developing a fourth pension pillar (allowing people to continue to accumulate while in part-time retirement, ‘challenging the bifurcation of accumulation and decumulation’.)

Japan is particularly impacted, with an 84.7-year life expectancy but their population understimates their expected longevity by 7 years, suggesting need for bold reform.

The So What: A stat-filled read that provides a wealth of innovation ideas for insurance companies and insurtechs.

Too many unmarried men?

A little something spicy for the weekend… This suggests that Western philosophy got it all wrong because its intellectual giants were lonely men.

UK philosopher Mary Midgley suggested as much in a controversial 1950s BBC script, recently unearthed. Philosophers like Descartes and Kant, living in bachelor isolation, developed abstract theories divorced from real human experience. A pregnant person, she noted, would never waste time pondering if other minds and other people actually exist they've literally hosted one.

The BBC rejected her piece as "trivial." But her insight – that who we are shapes how we think – is probably worth re-examining at a time when the West is going through a a time of navel gazing.

The So What? Tongue in cheek or not, it’s worth thinking critically where our good ideas come from, and in an era of anti-DEI, whether a shrinking pool or life experiences might become a business liability.

Bonus: AI Reports

20 curated AI project summaries from enterprise projects, covering McKinsey, BCG, Goldman Sachs, Google and more.

That’s all for this week. As always, feedback welcome. Feel free to share insights or links of interest.

- Stephen

The demographic transition figure is truly eye-popping. But, for me, it's the near doubling of the median age in just 50 years that makes the transition so unfathomable. To say that bold reform is needed in Japan is true British understatement. The challenge is stark.